Examining how Johnson & Johnson, Boston Scientific, and Abbott are positioning themselves in the IVL market through key acquisitions and a comparative analysis of their technologies.

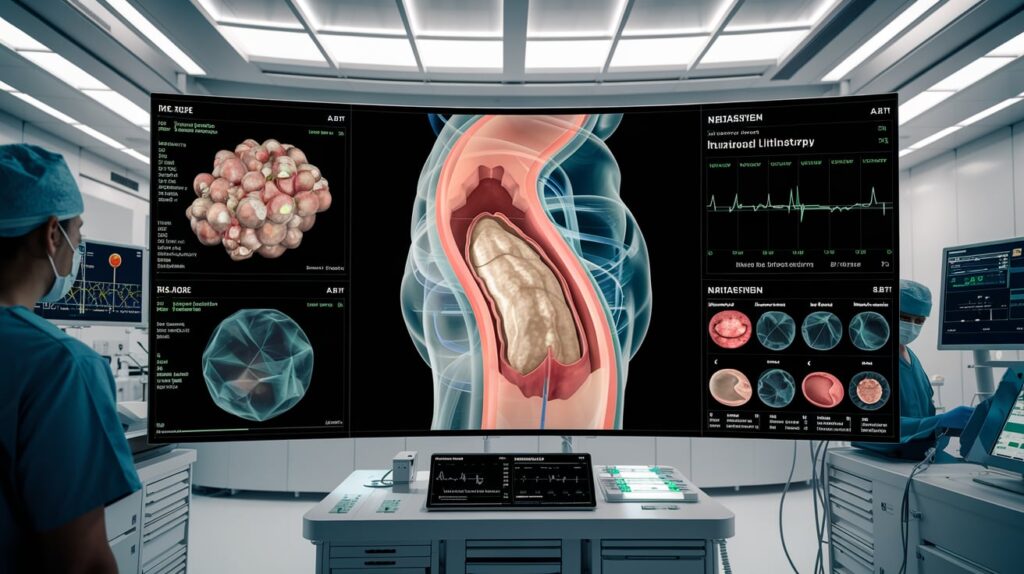

Intravascular Lithotripsy (IVL) has revolutionized the treatment of calcified arterial lesions, offering a minimally invasive solution that enhances patient outcomes. Recognizing the potential of IVL, leading MedTech companies have made strategic acquisitions to bolster their positions in this burgeoning market. This article explores the recent moves by Johnson & Johnson, Boston Scientific, and Abbott, including the financial details of these acquisitions, and provides a comparative analysis of the acquired technologies.

- Johnson & Johnson’s Acquisition of Shockwave Medical

In May 2024, Johnson & Johnson completed its acquisition of Shockwave Medical for $13.1 billion. Shockwave’s platform utilizes sonic pressure waves to fracture calcified plaques in both coronary and peripheral arteries, facilitating improved blood flow. This acquisition aligns with Johnson & Johnson’s strategy to enhance its cardiovascular intervention portfolio and address the global burden of cardiovascular diseases.

- Boston Scientific’s Full Ownership of Bolt Medical

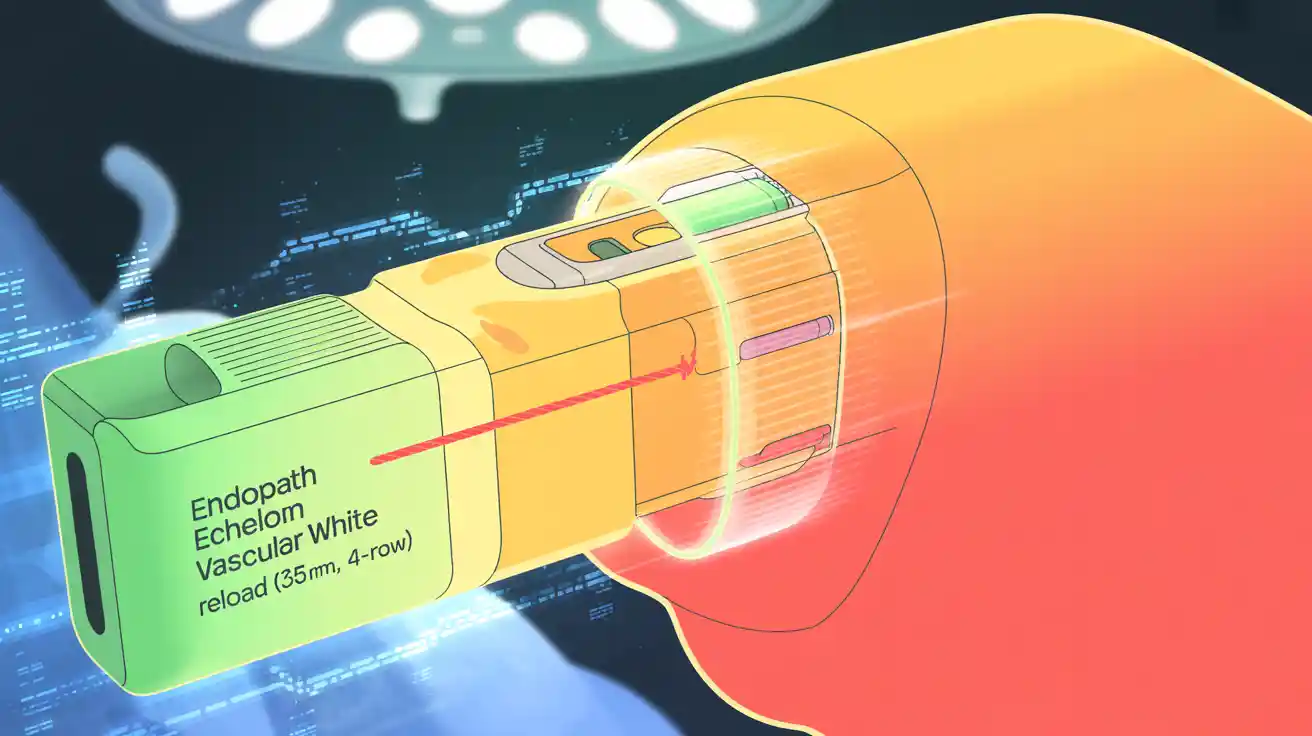

In January 2025, Boston Scientific announced its agreement to acquire the remaining 74% stake in Bolt Medical for $443 million upfront, with potential milestone payments totaling $221 million, bringing the total valuation up to $900 million. Bolt Medical has developed an advanced laser-based IVL platform designed to improve deliverability and efficacy in treating calcified lesions. This move fills a significant gap in Boston Scientific’s coronary artery disease portfolio, pending FDA approval of Bolt’s IVL system.

- Abbott’s Acquisition of Cardiovascular Systems Inc. (CSI)

Abbott completed its acquisition of CSI for approximately $850 million. CSI is renowned for its atherectomy devices, including the Diamondback 360 systems, which mechanically remove plaque from arterial walls. This strategic move enhances Abbott’s vascular device portfolio, providing complementary technologies for treating peripheral and coronary artery diseases.

Comparative Analysis of Acquired Technologies

Each acquisition brings distinct technological advantages to the respective companies:

- Shockwave Medical’s IVL Technology (Johnson & Johnson): Utilizes sonic pressure waves to selectively fracture both superficial and deep calcium deposits within arterial walls. This method preserves soft tissue integrity and is effective in both coronary and peripheral applications.

- Bolt Medical’s Laser-Based IVL Platform (Boston Scientific): Employs laser energy converted into acoustic pressure waves to target calcified lesions. The system boasts increased therapy pulses, enhanced deliverability with low crossing profiles, and directional emitters for targeted energy delivery, allowing treatment of various calcium morphologies.

- CSI’s Orbital Atherectomy System (Abbott): Mechanically sands away plaque using a rotating crown, facilitating lesion modification and vessel preparation for subsequent interventions like stenting. This approach is particularly beneficial for heavily calcified lesions.

These diverse technologies underscore the multifaceted approaches to addressing vascular calcification, each with unique mechanisms catering to specific clinical scenarios.

Market Expansion: By integrating these technologies, Johnson & Johnson, Boston Scientific, and Abbott are poised to expand their market share in the cardiovascular intervention space, addressing a significant area of unmet medical need.

The strategic acquisitions by Johnson & Johnson, Boston Scientific, and Abbott highlight the critical role of innovative technologies in advancing cardiovascular care. By integrating Shockwave Medical’s IVL, Bolt Medical’s laser-based IVL, and CSI’s atherectomy systems into their portfolios, these MedTech giants are poised to enhance treatment options for patients with calcified arterial diseases, driving forward the standard of care in vascular interventions.

Stay informed with MEDWIRE.AI for the latest developments and insights into the evolving landscape of medical technology and cardiovascular interventions.